In the ever-evolving landscape of agriculture and agribusiness, financial acumen is key to thriving and sustaining growth. The Certificate in Farm Financial Management is designed to equip participants with the essential skills and knowledge needed to navigate the unique financial challenges and opportunities within the agricultural sector. This program combines theory with practical application, ensuring that you can effectively manage finances, make informed decisions, and drive success within your farm or agribusiness.

This Program is designed for:

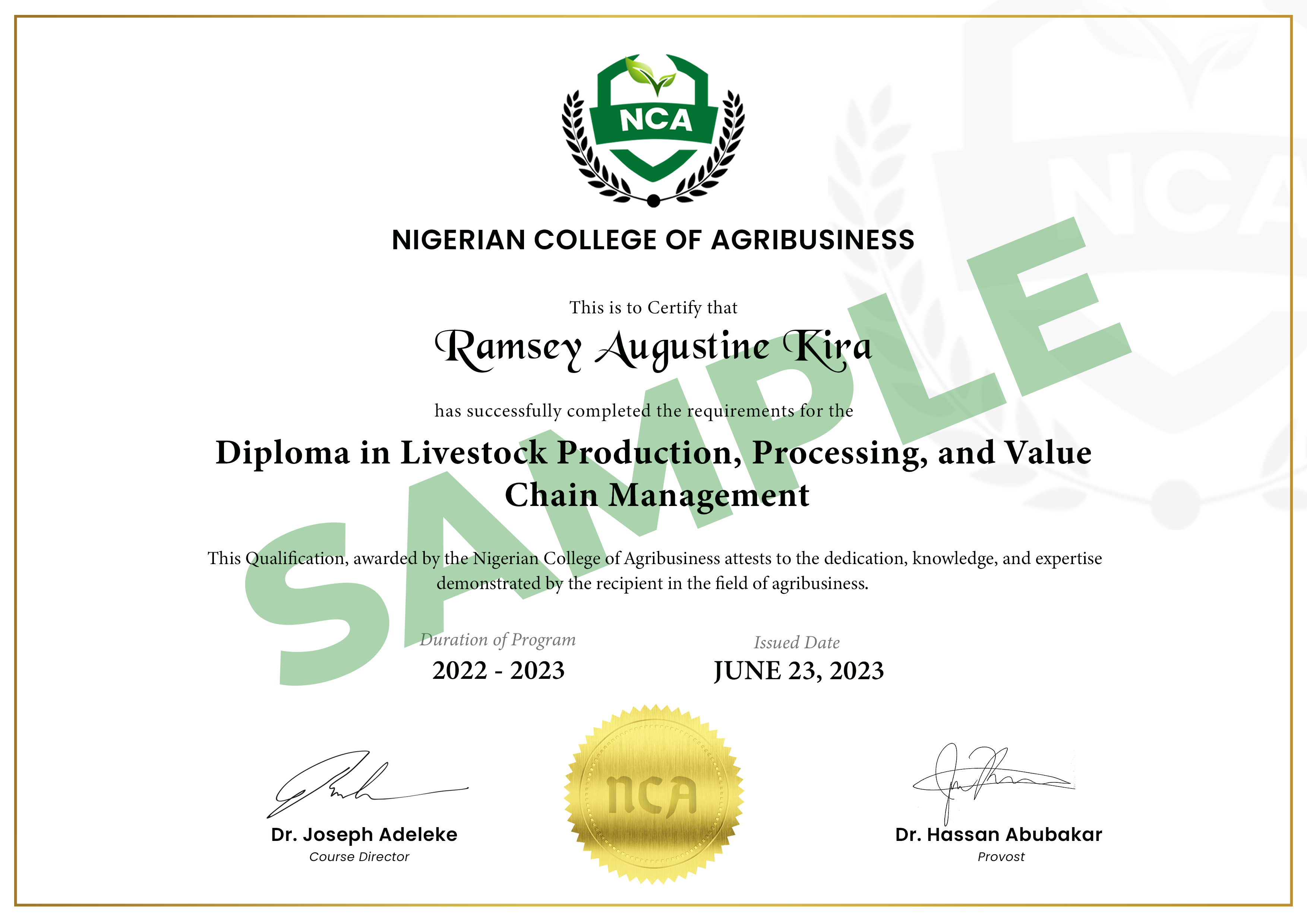

Upon successful completion of the program, participants will earn a prestigious Certificate in Farm Financial Management from the Nigerian College of Agribusiness. At convocation, graduating students will receive their Certificate as well as their Transcript of academic records.

Faculty members are experienced Chartered Accountants and Financial Managers with extensive consulting experience in the commercial agriculture industry in Nigeria and beyond.

NGN 250,000

April/May 2024 Stream

Click on the link below to fill the application form for this course

Do you need any further assistance regarding this program, send an email to: [email protected] or chat with a program executive on WhatsApp via: 09023789104 (Nigeria)

Ready to Begin your application process? Click on “Apply Now” to access the application form.

Established in 2022 and approved by the National Board for Technical Education (NBTE), the College provides high-quality specialized education that strives to improve the productivity, performance and continuous development of professionals in Nigeria. The College has the Centre for Environment and Climate Innovation, Centre for Agribusiness Enterprise, Centre for Centre for Nutrition and Wellness, Centre for Development Leadership, Centre for Farm Management and Centre for Food Business Innovation. Through these centers, the college delivers need-based professional education to diverse professionals across the country and beyond. In 2023, the Nigerian College of Agribusiness was admitted into E4Impact Alliance, a network of leading business schools in Africa helping startups in Africa to scale up and attain their full potentials. Other members of E4Impact Alliance include University of Professional Studies Accra, University of Makeni Sierra-Leone and Uganda Martyrs University Kampala.

Our mission is to cultivate a vibrant, sustainable and profitable agribusiness sector that drives economic growth and social progress across Africa and beyond.

We are committed towards educating a new generation of agribusiness sector leaders that will transform the economic fortunes of the African continent

© NCAEDU 2023 All Rights Reserved.